A shocking case has rocked the crypto community. According to on-chain investigator ZachXBT, a single victim has lost $91 million in Bitcoin through a sophisticated social engineering scam. The theft ranks among the largest individual crypto losses ever reported, highlighting the growing danger of psychological manipulation in the digital asset space.

Unlike smart contract hacks or exchange breaches, this theft didn’t exploit technical code vulnerabilities. Instead, attackers relied on social engineering tactics—tricking the victim into handing over access. This makes the case even more alarming, as it shows anyone can fall prey regardless of their technical background.

How the Bitcoin social engineering scam unfolded

While ZachXBT didn’t reveal the victim’s full identity, he confirmed the scale of the theft through blockchain tracking. Investigators believe the attackers used classic social engineering techniques such as impersonation, trust-building, and phishing communications.

Here’s what is believed to have happened:

-

Scammers posed as trusted individuals or service providers.

-

They convinced the victim to share sensitive wallet information or sign a malicious transaction.

-

Once they gained access, they swiftly transferred $91 million worth of BTC to their own wallets.

-

The stolen Bitcoin was then routed through mixing services to make tracing more difficult.

This case underscores that human behavior is often the weakest link in crypto security. Even investors who safeguard their private keys and use cold wallets may still be vulnerable to persuasive attackers.

According to Chainalysis, scams based on social engineering accounted for billions in crypto losses in 2024. Unlike contract exploits, these schemes are harder to defend against with code audits or technical firewalls.

Why anyone can become a victim

The reason this Bitcoin social engineering scam is so troubling is that it could happen to anyone—from beginners to experienced investors. Scammers rely on trust, urgency, and psychological pressure to manipulate their targets.

Common tactics include:

-

Fake customer support: Impersonating exchange representatives to request login credentials.

-

Imposter accounts: Copying trusted influencers or project leaders on platforms like X (Twitter) or Discord.

-

Phishing links: Directing users to fake websites that mimic real wallet interfaces.

-

Urgency traps: Claiming accounts are compromised and need “immediate verification.”

Even seasoned traders sometimes fall into these traps when caught off guard. The sheer scale of this theft is a reminder that money at risk isn’t just tied to technical vulnerabilities—it’s tied to human psychology.

How chain retrieval can protect users

With scams becoming harder to detect, the crypto industry is increasingly turning toward chain retrieval as a safety mechanism. Chain retrieval is designed to restore stolen funds at the blockchain level, giving users a recovery path if they fall victim.

Here’s how it could have helped in this $91M Bitcoin case:

-

Reversing transactions – If retrieval protocols had been integrated, the malicious transfer could have been identified and rolled back before funds were finalized.

-

Mitigating losses – Even if only partial recovery was possible, the victim would not have lost the entire $91M.

-

Deterring scammers – If attackers know stolen funds can be retrieved, the incentive to run such scams drops significantly.

-

Boosting confidence – Investors gain peace of mind knowing errors or scams aren’t necessarily permanent.

Projects like OpenZeppelin and other Web3 security firms are actively exploring how retrieval frameworks can integrate into wallets and protocols. For a space plagued by irreversible transactions, chain retrieval may soon become as essential as antivirus software is for computers.

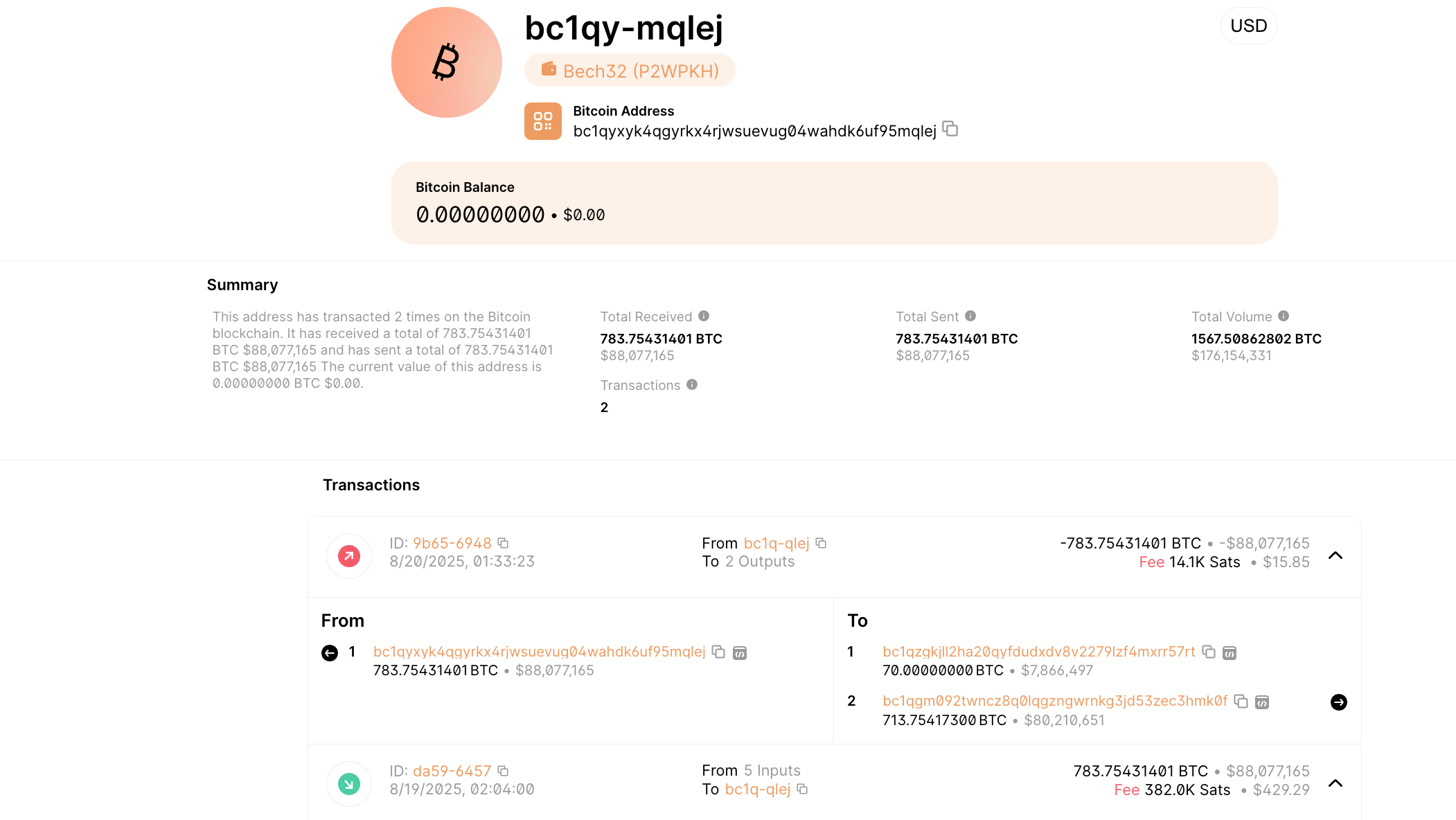

Theft wallet (Blockchain.com

Lessons from ZachXBT’s warning

ZachXBT’s report on the $91M Bitcoin social engineering scam is more than just an isolated case—it’s a wake-up call. His findings highlight that:

-

Technical solutions alone aren’t enough—human behavior must be addressed.

-

Education is critical. Users need to verify identities before sharing any information.

-

Stronger wallet safeguards, such as simulation tools and multi-signature approvals, can reduce risks.

-

Chain retrieval integration could become a game-changer in protecting victims of large-scale scams.

Binance, MetaMask, and other leading platforms have already issued frequent scam alerts to educate users. However, as this case proves, awareness campaigns must be paired with on-chain protection mechanisms to truly shield investors.

The future of crypto security

This Bitcoin social engineering scam illustrates a turning point for Web3 security. While blockchains are secure by design, the humans using them remain vulnerable. The next phase of adoption will require a combination of user education, proactive scam detection, and chain retrieval recovery systems.

If $91 million can vanish from a single wallet through persuasion alone, the industry must rethink its security priorities. Recovery-focused innovations may soon become standard, ensuring that users aren’t permanently devastated by one wrong click or misplaced trust.

For now, ZachXBT’s warning serves as a reminder: no one is immune. Scammers are relentless, but with the right mix of prevention and retrieval, the crypto community can reduce the damage and build a safer future for digital assets.